According to a new technical analysis, the Bitcoin price has returned to its “Crash Line,” fueling talk of a possible bullish turnaround. The expert behind this analysis has suggested that this is not a random event, but a deliberate move that could signal the beginning of Bitcoin’s next upward move.

Bitcoin Price Revisits Familiar Crash Line

In a recent post on X, market analyst Crypto Ticethe bull market, Bitcoin has consistently followed the same sequence each time the price returns to the Crash Line.

The process begins with momentum overheating, meaning buyers push prices up too quickly, creating unsustainable upward pressure. As this momentum builds, excessive leverage accumulates in the market, followed by a sharp correction. This price decline often brings Bitcoin back to the Crash Line. From this point, BTC usually starts gearing up for its next expansion phase.

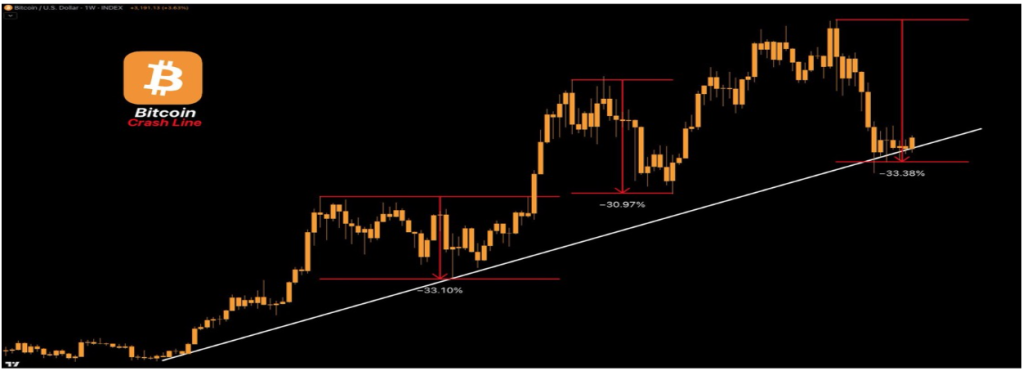

Crypto Tice shared a weekly chart illustrating this pattern. Each time Bitcoin approached the Crash Line, its price corrected by about 33.10% and 30.97% before quickly surging higher. Now that Bitcoin has returned to the Crash Line after a recent 33.38% drop, the analyst suggested it could follow the same historical trend and launch a major rally.

Crypto Tice also noted that the Crash Line has consistently marked leverage flushes, selling-pressure exhaustion, and trend continuation zones for Bitcoin. Rather than signaling structural weakness, the analyst said this trendline has acted as a transition point. He noted that if the broader structure remains intact, the Crash Line could mark the area where Bitcoin’s upside reloads.

Analyst Predicts Next Possible Moves For Bitcoin

In a separate X post, market expert Crypto Kingrecent rebound above $90,000. The analyst added that BTC’s liquidity and market participation are drying up, particularly as price moves sideways and the risk of getting caught in false moves increases.

As a result, Crypto King has outlined two possible scenarios for Bitcoin. If the cryptocurrency can push above $92,000 and hold that level, he expects it to flip from resistance into support.

On the other hand, if price fails to reclaim $92,000, the analyst predicts Bitcoin could decline again, this time testing the Chicago Mercantile Exchange (CME) gap at $88,000. The analyst has highlighted two potential demand zones on the chart: one around the CME gap and another extending lower between $60,000 and $50,000.

Featured image from Unsplash, chart from TradingView